With the UK being the only European country to see declining used car prices during 2022 and demand for new cars only just starting to stabilize after recent downward pressures, what next for the UK’s leading dealerships?

Political uncertainty over the coming months is likely to see continued interest rate rises, predicted to hit 6% in 2023, and it would be fair to assume this will put huge pressure on demand for new and used car purchases.

As the cost of living crisis continues to bite, the UK is now officially in recession. Growth is predicted to slump further amid continued double-digit inflation and a continued fall in living standards. How many people will put off their decision to upgrade their car in 2023?

Within the car retail market, there are also signs of shifting patterns in consumer spending. Demand for all-electric vehicles has slowed sharply as consumers look for more hybrid models. With home energy costs soaring amid the Ukraine crisis, the cost to charge a fully electric car becomes almost as expensive as filling it up with petrol. Consumers appear unwilling to shoulder the exorbitant cost of purchasing an all-electric vehicle if there are no savings in running costs downstream.

It would be fair to say that the near-term outlook for UK car dealers is less than rosy. So, how are all of these disruptions and challenges affecting the company performance and business values of the UK’s leading car dealers? After the pandemic period of lockdowns and restrictions, values recovered strongly, growing around 5% after a 2% fall in the previous year. This compares to a UK-wide average increase of 2% growth.

The top-level average masks some serious fragmentation in business value by the size of company. In total, over a quarter of the UK’s leading motor dealers saw their value fall in the latest year despite strong average growth. Only 308 firms have seen their value rise in each of the previous three years.

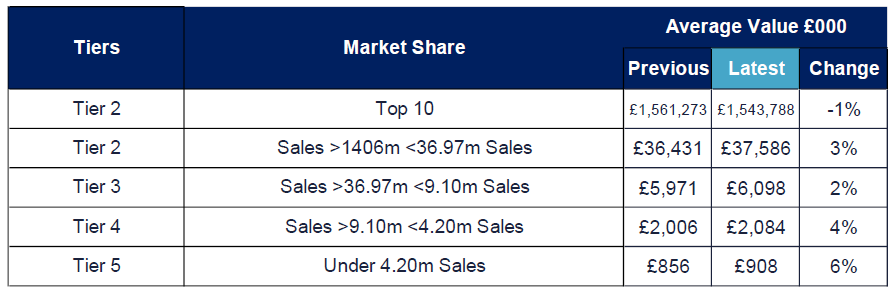

Within the industry, there is a growing divide in valuation performance based on size. The 10 largest dealers saw a 1% fall in their average valuations, perhaps reflecting an increase in M&A activity and consolidation. The largest rises in value were at the lowest end of the market at dealers with less than £4m sales. Values at the bottom end of the market are up 6%.

According to the latest Plimsoll Analysis, average company values across the car dealer sector have risen in the latest year by around 5%. That’s a sharp recovery from the 2% falls we saw in the previous, pandemic-ravaged year and beats the all-industry, UK average of just 2%. However, we are only this financial year seeing soaring inflation, the cost-of-living crisis, interest rate spikes and political crises so how long will that recovery last?

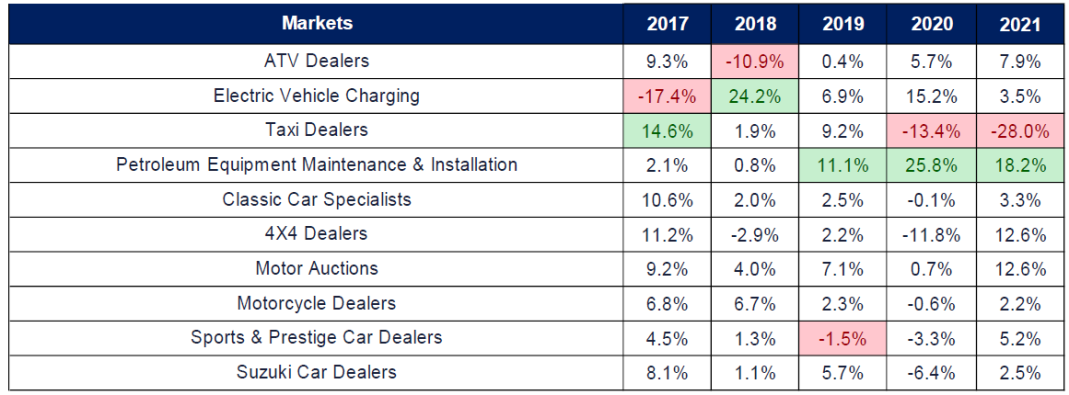

The final area worth mentioning is the comparisons across the food sector and the large contrast in fortunes depending on the type of dealership. Citroen and Suzuki dealerships saw the biggest rise in average values, up 16% and 12% respectively. Jaguar and Land Rover dealerships saw 30% falls in average values in the same period. What caused such a sharp fall at JLR dealers?

It is clear that the fortunes of car dealerships are intrinsically linked to consumer confidence and spending power. With the Government gambling on tax breaks to stimulate the economy but with a background of rising interest rates just as we enter a recession, will people be rushing into showrooms to update their car in the near future? Only time will tell.

To help our listeners make sense of these potential impacts, we are offering a free insight report looking at business value trends across the UK car dealer sector.

For a free copy of the latest Insights Report, please click here or email me at c.evans@plimsoll.co.uk and I will get the information to you immediately.

Published on: 6/10/2022